The higher the interest rate, the more your monthly payments will be, and vice versa. Interest rate: Your mortgage's interest rate is the amount your lender charges you for borrowing the money to purchase your home. The calculator uses a 30-year term as the default.

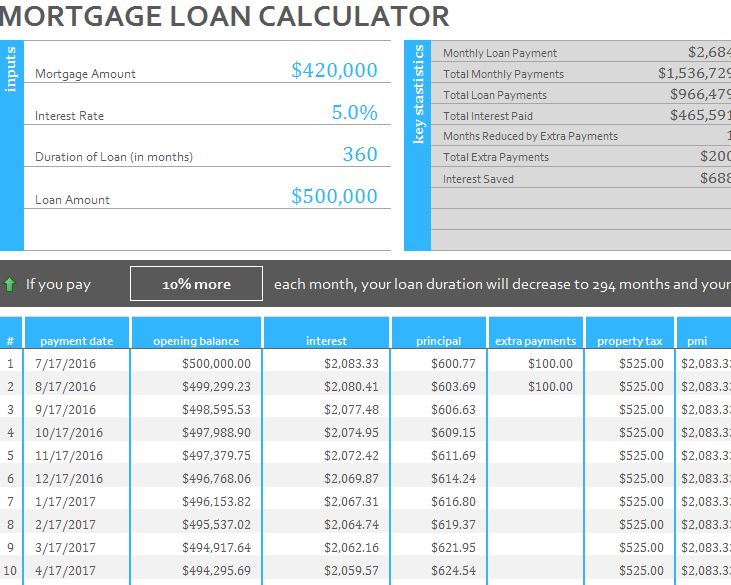

Shorter-term loans come with higher monthly payments and lower overall interest costs. Longer-term loans have lower monthly payments, but you'll pay more total interest. Length of the loan: The amount of time it takes to pay off your mortgage, known as the loan term, will have a big impact on cost and affordability. The calculator's default is 20%, which is what most financial experts recommend. They can be as low as 3%, depending on the loan type and your credit score. It will likely be more than your total loan amount, which will exclude the money you pay upfront toward the purchase.ĭown payment: Most mortgages require buyers to make a down payment. The purchase price of the home: This is the amount you agree to pay the seller. Here's what you'll need to estimate your mortgage payment with our calculator: Paying an additional $500 each month would reduce the loan length by 146 months.Lowering the interest rate by 1% would save you $51,562.03.Paying a 25% higher down payment would save you $8,916.08 on interest charges.

0 kommentar(er)

0 kommentar(er)